1098-T Tuition Statement Information

The 1098-T will be mailed out by January 31st.

*1098-T will not automatically be generated for a Non-Resident Alien (NRA). 1098-T will only be issued to a NRA upon written request. The deadline for requesting a 1098-T is March 1st. (Additional Information listed at the bottom of page)

Lehigh University is required by the Internal Revenue Services (IRS) to issue tax form 1098-T to any qualified student enrolled during the calendar year. IMPORTANT NOTICE: Starting with tax year 2018, the IRS mandated a change in 1098-T reporting requirements. All higher educational institutions are now required to report Payments received for Qualified Tuition & Related Expenses (QTRE) in Box 1 instead of reporting Qualified Tuition & Related Expenses (QTRE) in Box 2. NOTE: Through tax year 2017, Lehigh University reported QTRE in Box 2.

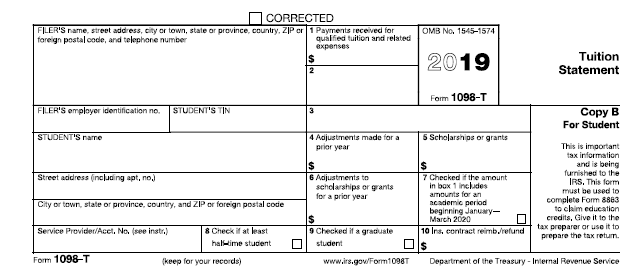

How to read at a glance the information on the 1098-T form:

- Box 1: Payments received for Qualified Tuition & Related Expenses. Includes payments made with personal funds and educational loans as well as most scholarships and grants.

- Box 2: Will be blank starting with 2018 tax year. Qualified Tuition & Related Expenses billed were previously reported in this box for tax years prior to 2018.

- Box 3: This box was checked for 2018 to indicate Lehigh University changed from reporting QTRE billed to reporting QTRE paid in compliance with the IRS mandate. Starting with tax year 2019, this box is blank.

- Box 4: Blank for the 2018 tax year because of the mandatory change in reporting. For 2019 and subsequent years, Adjustments to payments received that were reported in a prior tax year but were reduced in the current tax year.

- Box 5: Scholarships and grants credited to the student’s account during the calendar year regardless of the semester.

- Box 6: Adjustments to scholarships and grants that were reported in a prior tax year but were reduced in the current tax year.

Lehigh University cannot determine whether you are eligible to receive tax benefits that are available to persons who pay higher education cost through the Taxpayer Relief Act of 1997. Please consult your tax adviser or the IRS (search on Tax Benefits for Higher Education) for more information.

If you consented to receive form 1098T electronically, you can access it through the eBill Suite once an email notification is sent to you and your authorized user.

- Log on to https://go.lehigh.edu/ebill

- Select student (enter your Lehigh Credentials)

If you no longer have access to the eBill Suite, you can reset your Lehigh Credentials by logging on to https://www.lehigh.edu/forgot, or contact the helpdesk for assistance, 610.758.help (610.758.4357.)

For forms not distributed electronically, the form will be sent to your home address (as recorded in Banner), and will be mailed out by January 31st.

To Change your consent :

Please note that the ability to Accept or Withdraw Consent is disabled mid January to allow for annual generation of the 1098T forms.

To Accept Consent to receive the 1098-T electronically, log on to the eBill Suite (go.lehigh.edu/ebill), select "Consents and Agreements", select "Change", choose "Accept Consent".

To Withdraw Consent and receive your 1098-T through the mail, log on to the eBill Suite, select "Consents and Agreements", select "Change", choose "I Do Not Consent"

Changes to consent will only be effective prior to the delivery of the electronic 1098-T.

Please consult your tax adviser, or contact the IRS at:

IRS Help with Tax Questions Telephone: 1-800-829-1040

Local IRS Contacts: IRS Link

Telephone: 1-800-TAX-FORM (1-800-829-3676)

or select one of the following links:

Internal Revenue Service (IRS)

Internal Revenue Service Publication 970: Tax Benefits for Education

IRS Notice 97-60: Lifetime Learning Credit

IRS Form 8863: Education Credits (American Opportunity, Hope, and Lifetime Learning Credits)

Additional Information Regarding Non-Resident Alien (NRA) students

Lehigh University is not required to supply Non-Resident Aliens (NRA) with the form 1098-T according to the guidelines established by the Internal Revenue Services. We will generate one at the request of NRA students and forward the information to the IRS. However, to be in compliance with the IRS guidelines, we will not be able to generate any new 1098-T's for the prior year after March 1st.